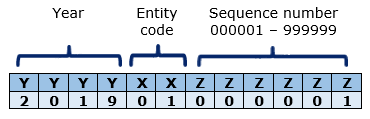

The new registration number format that consists of 12 digit numbers denote the following:

- First 4 digits - the year of business entity was registered

- Subsequent 2 digits - business entity code

- Last 6 digits - the registration number sequence

Example of the new registration number format is as follows:-

01 - Local company

02 - Foreign company

03 - Business (sole proprietor/partnership)

04 - Local Limited Liability Partnership

05 - Foreign Limited Liability Partnership

06 - Limited Liability Partnership for Professional Practice

During the transitional period, the existing registration number can still be used until further notice. Business entities are therefore not required to amend its existing company letterhead, invoices, signboards and all other printed documents. However, business entities are encouraged to use the new registration number format as soon as possible so that the company is prepared when the new registration number format is fully enforced.

You are able to check the new business registration number of your company via SSM's e-Search

You may also refer to SSM's FAQ for more information on the new business registration number or you may download the FAQ here.